Kiwisaver fees can add up to thousands of dollars over the course of your life. It’s important to be aware of how much you’re paying because Kiwisaver fees will have an impact on your long term returns. A few dollars here and there over the years can add up to a considerable difference over the life of your investment and to your retirement savings.

Types of Kiwisaver fees

Kiwisaver fees are charged to pay for the investment, management and administration cost of running the scheme. Kiwisaver fees can involve a number of separate elements, depending on your provider. These may include:

- An annual membership fee

- A management fee to cover the cost of managing your investments

- An administration fee

- A trustee fee

Why do some Kiwisaver funds charge more than others?

Recently Kiwisaver fees have been increasing. A report on Stuff revealed that there was a 13.5 per cent increase in Kiwisaver fund fees in 2019. The Financial Markets Authority's (FMA)s annual report on KiwiSaver showed that Kiwisaver providers collected combined fees of $479.8 million in the year to March 30 up from $418m the previous year.

The average KiwiSaver paid fees, including fund management fees and administration fees, of $163.53, compared to $147.39 the previous year. No other household bill had gone up 13.5 per cent since the previous year.

There are good reasons that some funds charge higher fees. They may be more actively managed and that can sometimes result in higher results. But, Kiwisaver fees will always reduce your returns, so you need to be comfortable that there is a good reason to pay higher fees with your provider. Is your provider doing more to manage the fees and getting better results? Are the higher fees worth it?

How much are you paying for your Kiwisaver Fees?

In today’s unusual environment many of us are facing the financial and economic uncertainty of the impact of COVID-19. This impact is likely to be felt for years to come.

The savings in your Kiwisaver fund are a vital source of security for your future. Whether you need help to buy your first home, you think you may need to rely on it if you face financial hardship, or you want to ensure you have a comfortable retirement.

It’s more important than ever to protect the money in your Kiwisaver, and ensure that high fees aren’t eating away at your funds. Your provider should be able to provide a clear breakdown of how much you are paying in fees.

JUNO Kiwisaver are doing things differently

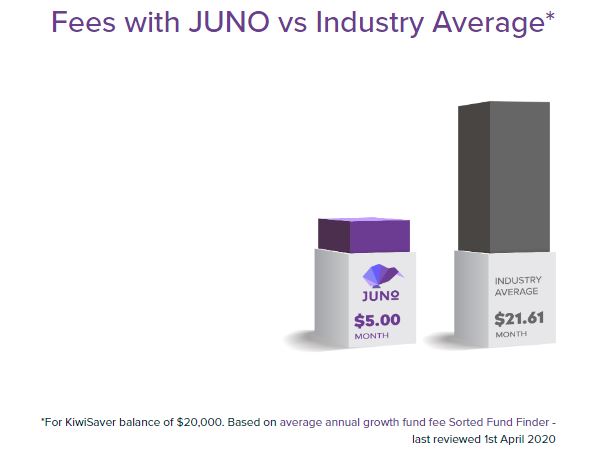

Providers like JUNO Kiwisaver are taking a new and fairer approach to Kiwisaver fees. They charge one, low, monthly fee based on your balance – similar to a subscription fee like Netflix or Spotify. These are very competitive when compared to the industry average.

Simplicity is key when it comes to Juno Kiwisaver’s fee structure:

- Free for under 18s or balances under $5k

- $5 per month for balances $5k - $24,999

- $15 per month for balances $25k - $49,999

- $25 per month for balances $50k - $99,999

- $50 per month for balances $100k - $1 million

(plus $100 per month for every million invested)

That means you know exactly what you are paying in fees up front. JUNO Kiwisaver are 100% Kiwi owned and operates, committed to responsible ESG investing and their funds are available to everyone.

Learn more about JUNO Kiwisaver

Please note:

This information was correct on date of publication. Money Compare is not a Kiwisaver Adviser, and this article is for information purposes only.