Mortgage repayments, these days, are a challenge to navigate. You may find yourself struggling to keep up with regular payments and be looking for ways you can lower your mortgage, or perhaps you simply want to be mortgage free sooner. By reducing your mortgage, you may feel a weight off your shoulders, see the light at the end of the tunnel, and be a few steps closer to making it to financial freedom, as a mortgage-free homeowner!

What is a Mortgage Repayment Made of?

A mortgage repayment is made up of principal and interest. Each mortgage is unique and structured differently, based on your income, and how much you can pay back, typically fortnightly or monthly.

What is Principal?

The principle is the amount of money you have borrowed from your lender and have to pay back.

What is Interest?

Interest is the amount of money that banks and other financial institutions will charge you for borrowing money. The interest rate will depend on the market rate, how much you can put down for a deposit, your income, and credit history. The interest part of the home loan can be the part that tends to hit your wallet the hardest.

Compare Interest Rates

Comparing your interest rates with other options available to you is a great way to find a better deal. Money Compare makes the habit of comparison easy and quick! Simply jump onto Money Compare and compare the interest rates of different lenders side-by-side. With Money Compare, you may find an interest rate that will deliver you big savings. You can ultimately refinance your mortgage, save more, and be on your way to paying the whole mortgage off!

Make Lump Sum Payments

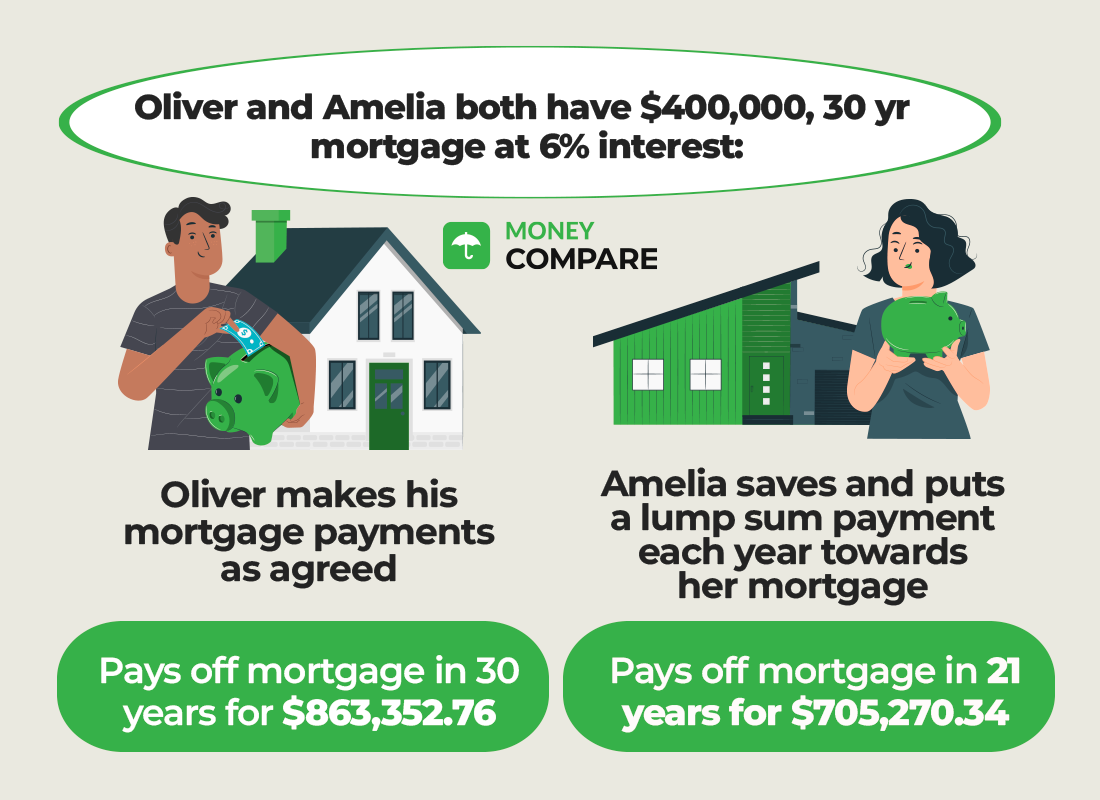

Do you have extra money from a payout, savings, or even a tax refund? Or have you sold an asset? If you have spare money, you could put it towards your mortgage. Just make sure you check the repayments contract to see if you can make extra payments without incurring any penalties. Some contracts will allow you to do so without applying a fee. Lump sums go towards the loan itself, not the interest, so a large payment will help reduce the amount you have left to pay, and the time it will take to finish.

Increase your Repayments

Similarly to the above, you can increase your repayment amounts to reduce your mortgage over time. Mortgages have a long life span. Therefore, making an increase to regular repayments will make a drastic difference to the lifespan and you will be able to wave goodbye to that mortgage a lot sooner.

Or if you happen to get lucky and see your mortgage interest rate go down, always continue with the same higher repayment as you have been doing, as more will naturally go on your principle instead of the interest. Again it is always best to check with your mortgage provider that this is an option and you won't face any fees as more will naturally go on your principle instead of the interest.

Extend the Loan Period

An alternative to increasing your repayments is to extend the lifespan of your mortgage. This is a good option for those who may be finding the repayment amounts a challenge and wish to ease the load. You can lengthen the loan period, and subsequently reduce your repayment amount, as it’s spread over a long period of time. Sometimes, paying it off quicker may not be in your best interest if it’s impacting you right now. There is nothing wrong with taking a little longer paying it off if it will protect your wellbeing!

Visit Money Compare For Ways to Reduce Other Expenses

Money Compare is a great tool to use to figure out where you can reduce your bills. Home insurance or car insurance? What about personal loans? Money Compare has the scoop on the best deals available to you. Take advantage of Money Compare to compare insurances and any money-related bills side-by-side to see if you are getting the most out of your hard-earned cash. You never know, you might find an insurance provider that offers more value for your money. It’s an incredible way to save hundreds of dollars over the course of a year.

Need Help? Our experts offer FREE advice

Here at Money Compare we have experts on hand to help with any home loan or mortgage query - simply request a free call back by clicking the button below and a fully qualified mortgage adviser will be in touch.