New research has revealed that three of the biggest Kiwisaver providers have scored some of the lowest levels of consumer satisfaction. Although Kiwisaver funds have charged their customers an impressive $415 million in fees last year (up 19% on 2017), consumers are less satisfied with the service they are getting.

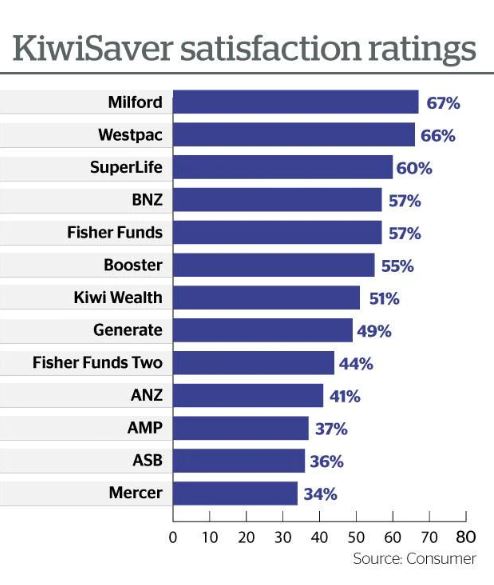

Kiwisaver customer satisfaction ratings

A survey carried out by Consumer New Zealand revealed that AMP, ANZ and ASB, three of the biggest Kiwisaver schemes and default providers all recorded below-average satisfaction scores. In fact, only:

- 36% of ASB customers;

- 37% of AMP customers;

- and 41% of ANZ customers were very satisfied with the service they were getting.

This is compared to an average of 48% across the 13 providers included in the research, which was down from 52% last year.

So which Kiwisaver providers came out top for customer satisfaction? The tops 3 spots were:

- Milford 67%

- Westpac 66%

- Superlife 60%

Quality of information

The last 12 months have been pretty bumpy for many Kiwisaver funds as sharemarket wobbles have cut into returns. It is likely that the fall in ratings was influenced by sharemarket volatility, which led to a bumpy ride for Kiwisaver funds.

But, the research also indicated that the quality of information customers got about their Kiwisaver fund also affected satisfaction.

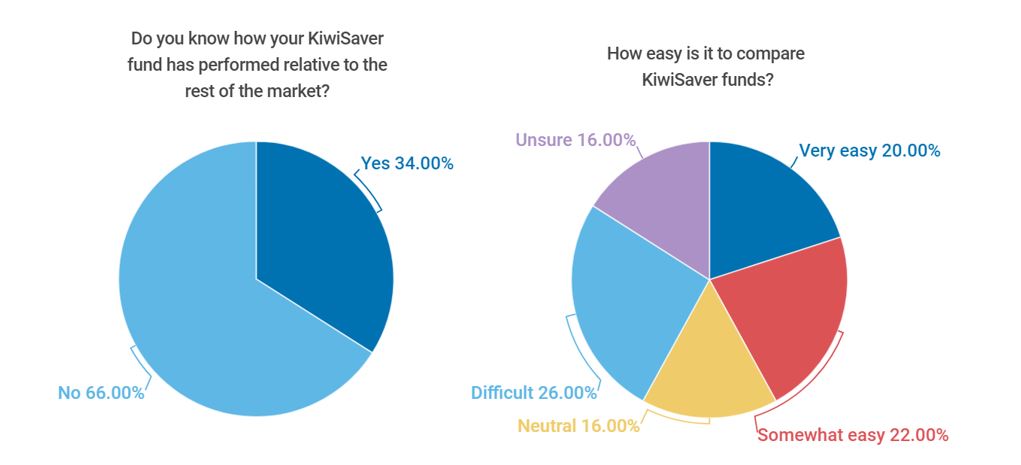

The research found that:

- Just 45% of KiwiSaver members thought their provider did a good job of keeping them up-to-date about their investment.

- 75% didn’t know what they paid in fees each year

- 66% were unsure how their fund was performing compared to the rest of the market

- 25% were unsure about what type of fund their money was invested in

- 42% of customers thought it was difficult, or were unsure that they had enough information to compare Kiwisaver funds

Kiwisaver Ethical investment

The research also indicated that consumer felt they didn’t know whether their money was being invested responsibly.

Sue Chetwin chief executive of Consumer New Zealand, said "For many, returns are just as important as knowing their money is invested responsibly.

"The majority said they'd be concerned if their cash was being invested in stocks such as gambling, pornography and weapons, but didn't know whether their fund manager excluded investment in these areas."

Six KiwiSaver funds are promoted as dedicated responsible investment options:

- AMP’s Responsible Investment Balanced Fund

- ANZ’s OneAnswer Sustainable International Share Fund

- Booster’s Socially Responsible Investment Balanced Fund, and Socially Responsible Investment Growth Fund

- QuayStreet’s Balanced SRI Fund

- SuperLife’s Ethica Fund